In a surprising turn for the tech world, Apple and Google have unveiled a major multi-year collaboration that’s sending ripples through markets and Wall Street alike, and investors appear to be the big winners.

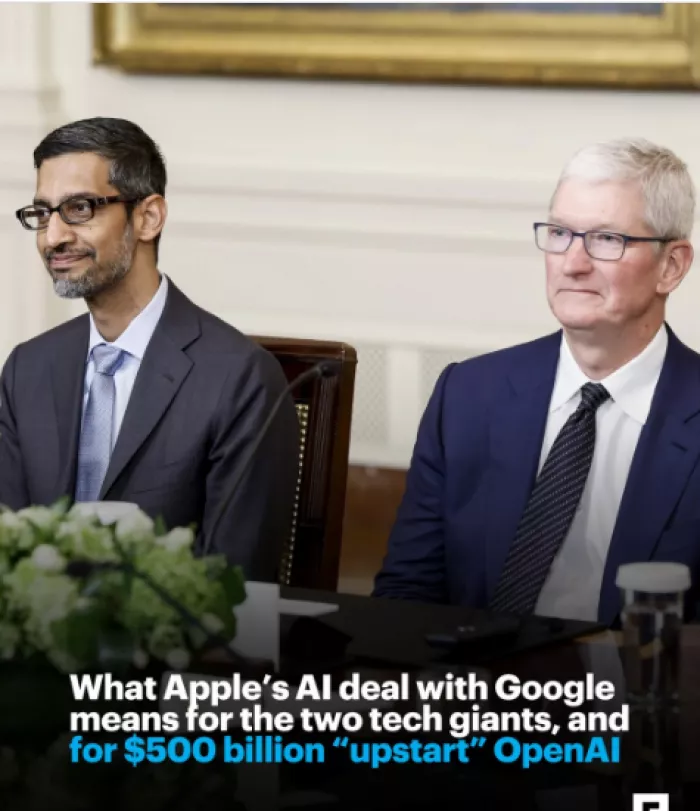

On January 12, 2026, Apple announced it would adopt Alphabet’s advanced Gemini AI models to power a significantly enhanced version of Siri and broader Apple Intelligence capabilities. The deal, confirmed by both companies in a joint statement, marks a pivotal moment in Apple’s AI strategy and a major validation for Google’s AI leadership.

Investors reacted positively following the announcement: Alphabet’s market capitalization surged above the $4 trillion mark shortly after markets opened, underlining confidence in Google’s AI roadmap and future growth prospects. Analysts believe the integration of Gemini into Apple’s ecosystem, covering billions of active devices worldwide, could significantly expand Gemini’s distribution and revenue potential over the next several years.

Meanwhile, Apple’s shares also steadied after early market volatility, as analysts pointed to the partnership as a strategic move that safeguards Apple’s competitive position in the rapidly evolving AI landscape without the massive infrastructure costs of building cloud and AI systems from scratch.

For years, Apple has been cautious about AI, preferring to rely on internal development rather than deep partnerships. But with competitors like Google, Microsoft, and OpenAI pushing large-scale AI deployments, Cupertino’s leadership chose to accelerate its AI progress by licensing Gemini as the cornerstone of its next generation of intelligence features. This approach lets Apple deliver a smarter Siri and richer AI experiences on iPhones, iPads, and Macs while still adhering to its strict data-privacy philosophy.

Industry watchers note this also helps Apple avoid spending tens of billions on cloud infrastructure, a cost that could have weighed heavily on margins and investor sentiment.

Market analysts see the collaboration as a win-win for shareholders of both tech giants:

This deal also reshapes competitive dynamics in the AI sector. By choosing Google’s model over other options, Apple has tilted the balance in the ongoing battle between the major AI players, reinforcing confidence in Gemini’s technical prowess and distribution reach.

At the same time, some rivals and industry commentators have raised concerns about the concentration of influence that comes from an even deeper Google foothold in Apple’s ecosystem, including commentary on privacy, data use, and the competitive landscape.

For now, investors seem focused on the near-term financial and strategic benefits. With new AI features rolling out later this year and broader Apple Intelligence enhancements in the pipeline, Wall Street expects both companies to capture incremental gains in sales, user engagement, and long-term growth prospects.

Discussion